Non-executive directors (NEDs) face significant risks under the Jersey Civil Penalties Regime. At a recent webinar, Club NED and Board Intelligence examined how NEDs can manage these risks and drive effective governance on an offshore Board

Personal fines are coming, so get your board in order. That was the message to NEDs in the wake of recent penalties meted out to local businesses under the Jersey Civil Penalties Regime (JCPR).

Since 2018, the Jersey Financial Services Commission (JFSC) can impose penalties of up to £400,000 on Principal Persons. However, as yet, no fines have been issued against individuals.

“The JCPR is about improving culture and governance, building confidence, and driving greater personal accountability,” Niamh Corbett, Director, Board Intelligence said. “We would expect to see a rise in fines as the gaze shifts from corporate governance to the role and responsibility of individuals.”

Growing risks for personal fines for NEDs under the Jersey Civil Penalties Regime

The JCPR is based on the same three pillars as the UK’s Senior Managers Certification Regime (SMCR). This came following calls from the Parliamentary Committee on Banking Standards to reform governance in financial services after 2008.

Niamh said: “The UK SMCR has become a global benchmark, with jurisdictions such as Hong Kong, Singapore, and Ireland adopting their versions of the regime. People see it as one of strictest codes and it probably represents a reasonable roadmap for the direction of travel in the offshore world. In the UK, companies have been fined, and individuals too. For example, Jes Staley, CEO of Barclays, was fined £642,000 in 2018 for breaching conduct regulations related to whistle blowing. It is likely individuals may come under similar scrutiny in Jersey and end up facing fines.”

Responsibilities for non-executive directors in Jersey

During the webinar, Board Intelligence highlighted the responsibilities Non-Executive Directors face to carry out their duties effectively. This covers a wide range of areas, including Board Packs.

Niamh said: “Non-Executive Directors have a role ensuring the information they receive is relevant for purpose. It needs to cover what is essential and relevant, without causing information overload. This may involve management writing board papers using a template to improve consistency and ensuring materials cover the five steps for effective compliance and good governance.”

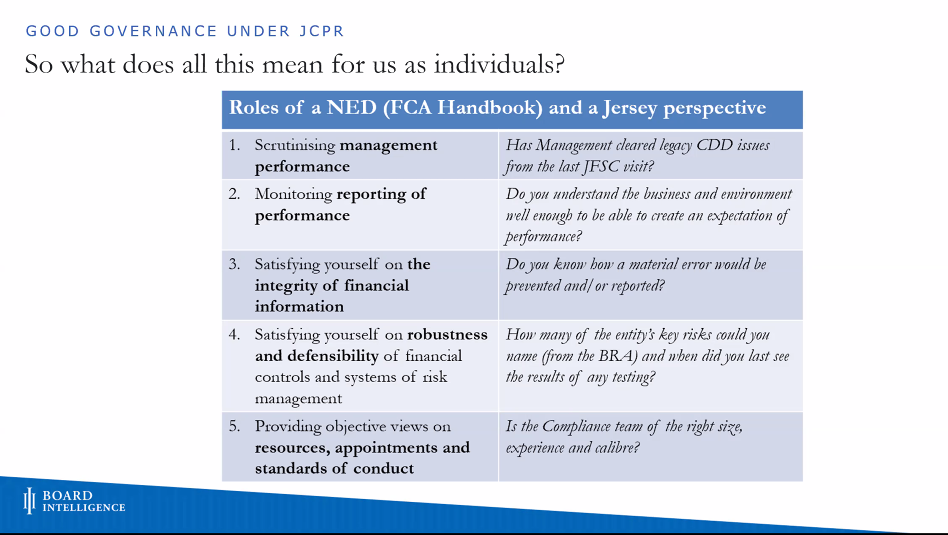

Mark Hucker, for Club NED, highlighted some of the responsibilities for Non-Executive Directors under the SMCR and how they may help non-executive directors (NEDs) manage the personal risks they face under the Jersey Civil Penalties Regime.

“NEDs should fully understand what is happening with an organisation to be able to hold management to account. Furthermore, they should be confident in the reliability of information they receive. This involves actively monitoring performance and being able to assess the effectiveness of internal controls and risk management. NEDs also need to maintain and present an objective view of the quality and resources of the organisation.

“We should take actual or potential issues coming from a failure of systems and control just as seriously as a breach itself. It’s about the robustness of financial control, not just whether a specific failure has happened. One of the real skills for a Director is seeing future problems and acting to prevent them becoming a crisis.”

Good governance involves identifying failures in a system before they become a breach

The recent case against Citigroup, where it was fined for ineffective systems and controls, illustrates how Directors must ensure management acts swiftly and effectively if systemic issues arise.

Mark added: “With the next Moneyval visit on the horizon it’s likely the first fines in Jersey will be in relation to financial crime, especially around money laundering. The fines have been getting bigger for organisations, and in Guernsey, an individual has faced fines too.”

While this all sounds like a lot to take on, resigning will not necessarily save you. In the UK, regulators are clear they can go as far back as necessary when investigating failures by a Board.

There are still ways NEDs can manage risks faced under the Jersey Civil Penalties Regime to make boards more effective.

Mark said: “Boards need to recruit Non-Executive Directors from a wider, more diverse talent pool. They will subsequently bring a valuable and complementary skill set. Those NEDs should take the regulations and their roles seriously. They must spend time understanding the business and issues, ensuring they get the materials they need. Also, they need to be active in challenging management.”

Niamh said: “If you start with the right models for good governance and have the right people at the table, with the right information to make the right decisions, you are setting up your board to succeed.”

Find out more

Information from the Webinar and subsequent editorial is the opinion of its authors. This should therefore not be taken as legal or financial advice.

For more information on smarter board packs please see www.boardintelligence.com

To find out more about future Club NED events, please sign up for the newsletter.